by Niall G Lynch Insurance & Financial Services | May 5, 2020 | Financial Advice

Forward thinking Financial & Estate Planning Following on from the theme of my previous article this piece also focuses on the link between financial planning and estate planning. The benefit of prudent financial and estate planning can have the dual effect of...

by Niall G Lynch Insurance & Financial Services | May 1, 2020 | Financial Advice

Introduction – The many purposes for Life Insurance Life Insurance/ Life Cover can be taken out for various reasons and to protect against and plan for a variety of scenarios, as a result of the death of the life assured. Often people are unaware of the value of...

by Dylan Lynch | Aug 9, 2019 | Financial Advice

A Mortgage Protection policy is often a time-sensitive policy, people want to get it in place ASAP to draw down their mortgage. It means that you have a policy to clear your mortgage in the event of the death of you or your partner. The life cover decreases in line...

by Dylan Lynch | Aug 9, 2019 | Financial Advice

How does a Specified Illness policy work? Being diagnosed with a Serious Illness is a risk we are all exposed to. Unfortunately, rates of diagnosis are on the rise. This diagnosis can be life-altering in many ways. A very common issue for people is increased financial...

by Dylan Lynch | Jul 19, 2019 | Financial Advice

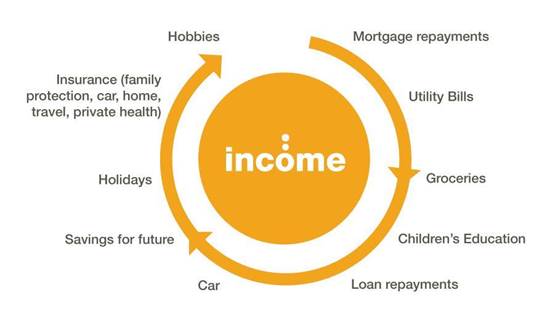

Do you have a more important asset than your income? Is it protected? Income Protection and why it helps Why do I need Income Protection? Your income is your most important asset, it is the glue of your finances. If you have a family, their financial well-being and...

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Recent Comments